Taking on your first employee can be daunting, but is a task that must be overcome for businesses that have the ambition to grow. Hiring employees will allow you to be able to focus on what you are best at, as opposed to being a generalist covering all areas of the business.

That said, employing staff will require you to take on many administrative and compliance responsibilities related to their remuneration, rights and general well-being. It is imperative to give this some upfront thought to ensure that you abide by all legal responsibilities, as well as understanding the financial implications this will have on your business.

Most employees should be issued with a contract. This can be either be in the form of a written document or as a verbal agreement.

If you are unsure whether an individual is classified as an employee or contractor, refer to the rules surrounding IR35. This is legislation from HMRC which seeks to identify whether contractors are in effect acting as disguised employees. If contractors are found guilty they, as opposed to the company paying for their services, will face financial penalties.

Employment contracts should outline the key terms of the engagement including job titles, descriptions, salary, hours of working, probation period and holiday entitlement.

Full-time employees in the UK are entitled to a minimum of 28 days paid annual leave. This statutory minimum takes into account eight national bank holidays.

Companies operating within an innovative or specialist sector may choose to issue non-compete clauses to restrict employees from working for competitors for a set period once their employment ends.

Original signed copies of contracts should be retained internally. Use HR software to lessen the admin burden

Software tools such as CharlieHR, Zenefits and Breezy allow companies to manage most HR processes and tasks including storing personal data, processing and logging employee holiday requests, performance reviews and data related to payroll.

Incorporating a cloud HR solution can save time and smaller companies may overcome the need to hire a member of staff specifically devoted to HR activities.

These tools are relatively inexpensive, with monthly subscriptions starting from a few pounds per month per employee. Many providers also offer free trials.

Taking on staff requires companies to take out employers’ liability insurance, which protects them against compensation claims relating to employees becoming injured or ill arising as a result of the work they perform.

In most instances, it is a legal requirement to have cover even if the people working at your company are contractors or casual workers.

Failure to have insurance can result in companies being fined £2,500 for each of the days not covered. Policies must have at least £5 million of cover from an authorised insurer.

If you have business insurance in place already you can usually add employer's liability insurance at a reasonable low additional cost, so it's best to contact you existing insurance provider in the first instance.

Employing staff will require you to maintain payroll, which calculates the net amount of salary which should be transferred to employees, as well as the corresponding deductions for employees national insurance, pensions, and student loans.

Additionally, payroll will also calculate employers national insurance, which is payable in addition to employees’ gross salaries.

The first step for companies setting up payroll is to register as an employer with HMRC to get a login for their PAYE online service.

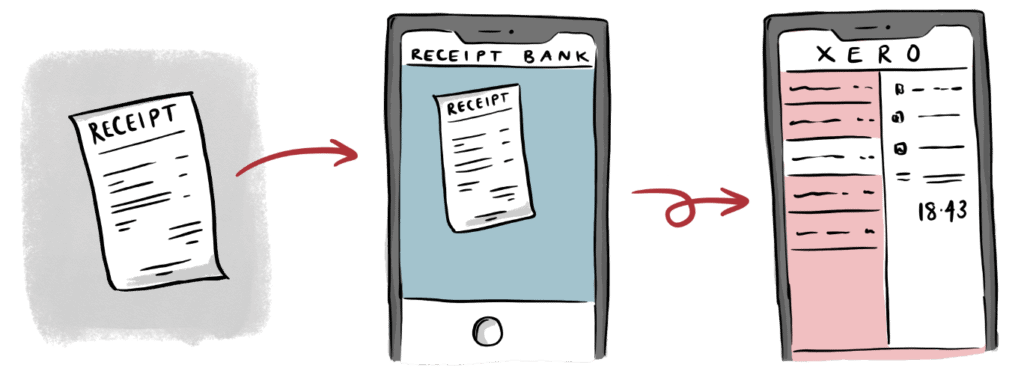

Companies then have to choose which payroll software to use to record pay, make deductions and report this information to HMRC.

Payroll must be reported to HMRC every month electronically through RTI filings, and most of the main software providers (such as Xero, Quickbooks, Sage, etc) have this functionality.

Mistakes related to administering and calculating payroll can be costly and time-consuming so you may wish to outsource this activity to your accountant, as opposed to performing it in house.

Barnes & Scott perform payroll and its associated set up on behalf of all of their clients. Whilst Xero’s payroll feature is suitable for companies with a couple of employees, Barnes & Scott set up all of their clients with Brightpay Connect. This is a cloud solution which is a more robust solution with increased functionalities.

Barnes & Scott’s procedure for their streamlined payroll process can be viewed on our support site.

The government now requires all companies in the UK to set up and administer a workplace pension scheme for their employees.

Under most conditions, employees are automatically enrolled within the scheme unless they choose to opt-out. The scheme is based on employers having to match the contributions of employees.

The rates are subject to change each year, but in the current tax year employees are required to contribute a 5% deduction from their salary, with this being part matched by the employer at 3%.

Companies will need to pick a pension scheme. There are many different providers on the market, with NEST being particularly popular due to being set up by the government, its ease of use and being open to all employers.

The Pensions Regulator website provides detailed guidance on picking a scheme, alongside future planned changes such as contribution rates.

Companies can save £4,000 per year on their employers class 1 national insurance (Class 1 NICs) by claiming for HMRC’s employment allowance.

This was first introduced in 2014 to encourage companies to take on staff. It is eligible for all businesses and charities paying employers Class 1 NICs.

The employment allowance can be claimed through your payroll software, or by your accountant, when sending an Employment Payment Summary (EPS) to HMRC.

If you have been employing staff for a few years and have not already claimed for the allowance, you can retrospectively claim for it back to the 2015/16 tax year.

To budget for taking on new employees, companies should consider the full cost of taking them on before committing.

In addition to paying their gross salaries, companies have to pay for employers Class 1 NICs (up to 12%) and employers pension contributions (3%).

Example calculation

| Full time salary | £40,000 |

| Employers Class 1 NICs (13.8% above £8628 per year) | £4,329 |

| Use of annual employment allowance | -£3,000 |

| Employees pension contributions (3%) | £1,200 |

| Annual cost to employer | £42,529 |

Note: As this example is based on a company taking on their first employee, the annual employment allowance will not apply to further employees taken on.

Setting up an EMI share option scheme can be an effective way for high growth companies to attract and retain experienced employees, who would ordinarily command higher salaries.

EMI is a tax-efficient scheme for employees, as they do not have to pay any income tax when the options are granted nor when they are exercised to buy the shares.

The only tax payable by employees is when they sell their shares. In these circumstances, they pay capital gains tax on their uplift in value, at a reduced rate of 10%, due to being able to utilise entrepreneurs relief.

ACAS is a free and impartial information service that gives advice to employees on workplace issues and employment law.

Their website includes several templates and guides around legislation and best practice.

Additionally, becoming a member of the FSB (costing around £150 per year) has many HR benefits including legal support and online training modules. Barnes & Scott are a member of the FSB and have found them to be a useful resource for both themselves and their clients

We use technology to do the heavy lifting, resulting in a Zen-like state for your finances, freeing up headspace to run your company.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.