Global sales can be hard to keep track of. We’ll ensure your sales comply with UK tax laws and can guide you when to take action in foreign jurisdictions.

Most of our tech clients have worldwide sales, often selling digital products and services to a global customer base. We can help you with global sales reporting, for the EU markets (including ‘VAT Moss’ on digital services in EU) and non-EU markets, so your business complies with UK tax laws. We also help clients automate the reporting of global sales.

As your business grows and increases sales globally, accounting for each sale in the UK becomes trickier. For example, VAT on business to consumer (B2C) sales of digital services in the European Union (“VAT Moss”) are reported one way, whereas B2B sales or sales to customers based outside the EU are subject to different accounting and tax rules.

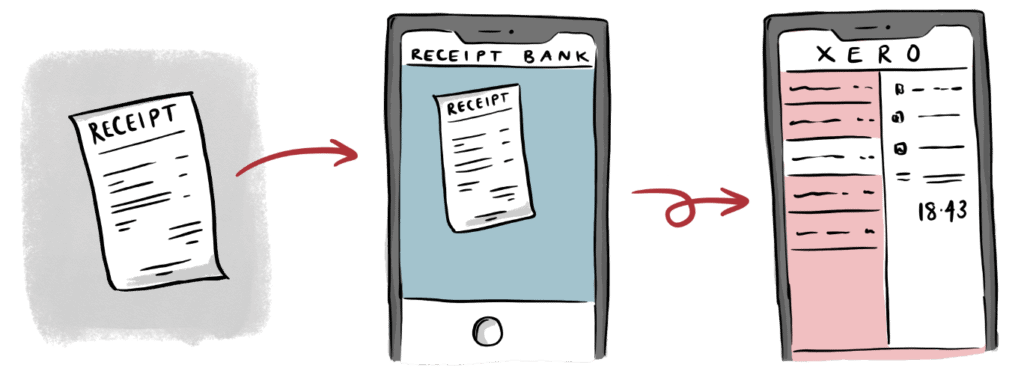

Some accounting firms struggle to cope with reporting global sales. It’s second nature to us, because it applies to the majority of our customers. For example, if you collect payments from customers using the Stripe platform, we can help you automate your sales process, integrate your invoicing with Xero and ensure that your customers all receive the correct tax treatment no matter where they reside.

As the UK has now left the EU some of the red tape tech companies face in dealing with EU sales has been simplified. However, this is not the case for all businesses – those of you selling software to consumers in Europe will still need to comply with VAT MOSS regulations, which means registering in Ireland to file these returns as it can no longer be done in the UK. We’ve helped clients with the process of getting set up in Ireland for VAT MOSS. We can do the same for you.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.