R&D tax credits are a tax incentive from the UK government to encourage companies to undertake innovative development in science and technology. To claim it, your company must seek to develop an advance in its field by overcoming specific technical challenges. Our clients have made over 100 claims for R&D tax credits, saving a total of approximately £10 million in tax, with an average rebate per start-up of £47,000.

Barnes & Scott works with innovative technology companies. Many of our clients already qualify for R&D tax credits. We regularly assess all our clients to check that they are claiming the maximum possible for R&D.

Our specialist R&D team will work closely with our accounts team to pore over your financials and pull out all relevant information to maximise your claim. One of the benefits of working with Barnes & Scott is that we manage your bookkeeping and accounts, as well as your R&D claim. That means we have a detailed insight into your financial data, which is key to putting in a strong claim and ensuring nothing gets missed.

There are two types of R&D relief – the SME scheme and the RDEC (Research and Development Expenditure Credit) scheme for large companies. The SME scheme is the most common, and most generous, typically resulting in a 19% cash rebate of the amount spent on R&D.

The RDEC scheme must be used if the development work has been funded by a grant, such as from Innovate UK, a government agency that invests in science and research in the UK. The RDEC scheme is less generous, typically resulting in a rebate of just under 10%

Barnes & Scott is an expert in both types of R&D and has helped many companies successfully navigate the rules of both schemes.

The number of claims for R&D tax credits made by small companies has risen sharply in the past few years, especially from London based companies who claimed for 31% of all R&D tax credits in 2020-21.

To get the tax relief, your business must demonstrate to HM Revenue & Customs (HMRC) that your R&D project did two things: one, it tried to make a technical advance in your field (not just an improvement for your business); two, the project faced “uncertainty” which had to be overcome (for example, the project may have failed initially but eventually succeeded by solving certain technical challenges).

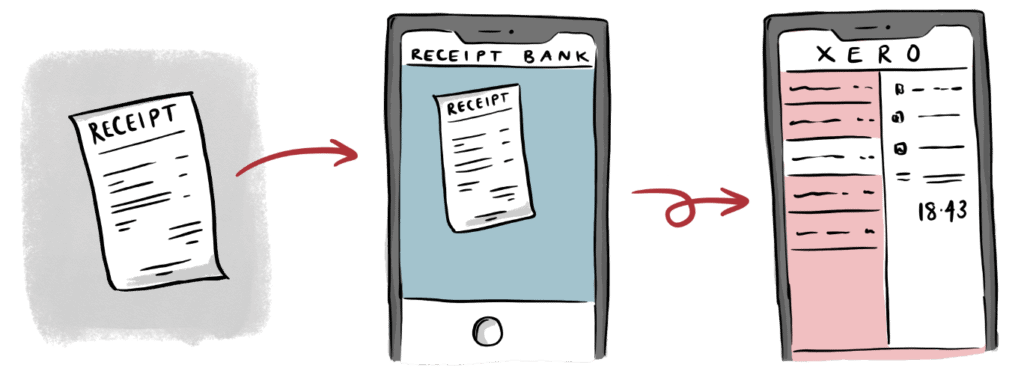

Submitting an R&D tax credit claim can be complicated and time consuming if you try to submit it yourself.

Let us do the hard work. We’ll analyse every part of your business to establish if you’re eligible. Then we’ll work out the maximum amount you are eligible for. We’ll write the claim, include it as part of your corporation tax return and deal with any red tape and queries from HMRC.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.