EMI is a government tax break aimed at start-ups. It helps high-growth, cash strapped companies recruit and retain employees by allowing them to benefit from growing the business.

A share option is an option to buy a share in the company at some point in the future, at a discounted price. If the company’s valuation rises the employee will benefit by having the option to buy the shares for much less than they are worth.

EMIs are flexible schemes with generous tax breaks for employees. Employees normally pay tax and national insurance when they receive shares in a company. However, under an EMI scheme, employees don’t pay any tax when they receive their options, if the options were issued at market value.

Employees also benefit by only paying a 10% Capital Gains Tax, as opposed to the standard 20%, when the shares are eventually sold to a third party ‒ for example if the whole company is bought or floats on the stock market.

EMI is the most popular and tax effective share-option scheme for start-ups. In their early years, start-ups often have good potential for growth but are cash poor. As a result, the salaries they can offer probably won’t be enough to attract and retain the best employees. A good share option scheme can make all the difference.

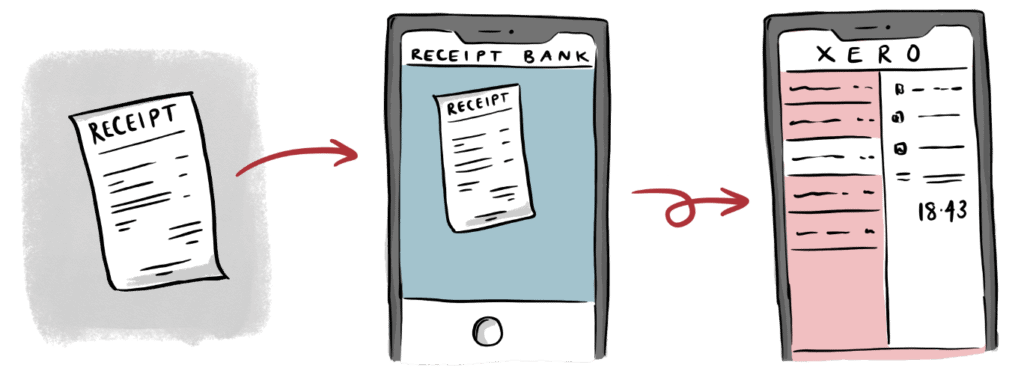

We’ll check that your company qualifies for the government’s EMI scheme. Then we’ll work out all the details, including which employees get the rights to share options, what type of shares, and what happens to the share options if an employee leaves your company. We’ll file all the paperwork and agree a valuation for your company with HM Revenue & Customs (HMRC).

We’ve helped dozens of companies create EMI share option schemes.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.