Registering for VAT is a rite of passage for any successful start-up. It adds a layer of complexity to your tax arrangements, but also offers some very useful advantages. Barnes & Scott has a huge amount of experience helping start-ups become VAT registered. We usually act as agents for our clients, managing registration with HMRC, helping implement processes to ensure compliance, and then managing the quarterly filing process.

A business must register for VAT if total turnover for the last 12 months was over £85,000, or if you expect your annual turnover to exceed £85,000 within the next 30 days. Businesses with a turnover yet to pass £85,000 can also register for VAT voluntarily. The best time to take this step will depend on the specific circumstances, characteristics and prospects of the business, but there are some good reasons to consider early registration.

One advantage is that registering for VAT often increases cashflow. In part this is simply because the business will hold VAT temporarily before paying it to HMRC, but it is also because most start-ups tend to be spending money but not making big profits. That means you will usually be able to reclaim VAT via your first few returns, because the amount you are spending is greater than the amount you receive through sales. HMRC also adds some Repayment Interest to any tax due to be repaid to a business.

It’s also possible that registration will add credibility to your company’s image in the eyes of some potential customers, in part because being VAT registered may mean the business appears to be larger and more stable than some of its competitors.

We’ll be very happy to work with you to help you decide when to begin the registration process while turnover is still below the £85,000 threshold.

Barnes & Scott usually handles VAT registration for our clients before acting as agents for them. All you have to do is fill out a simple form here, and we’ll take care of the rest.

Alternatively, registration can be completed online. Going through this process will also create an online VAT account through which the business will then make VAT payments to HMRC. You can take this option but still appoint Barnes & Scott as your agent to submit VAT returns and deal with HMRC on your behalf.

A VAT-registered business must charge VAT on all UK sales of goods and services that are eligible for VAT, but the business can also claim back VAT on purchases from suppliers that charge VAT. In a way, every VAT-registered business becomes a middleman for VAT: collecting the tax from customers and paying it to HMRC; and reclaiming the VAT that the business pays suppliers.

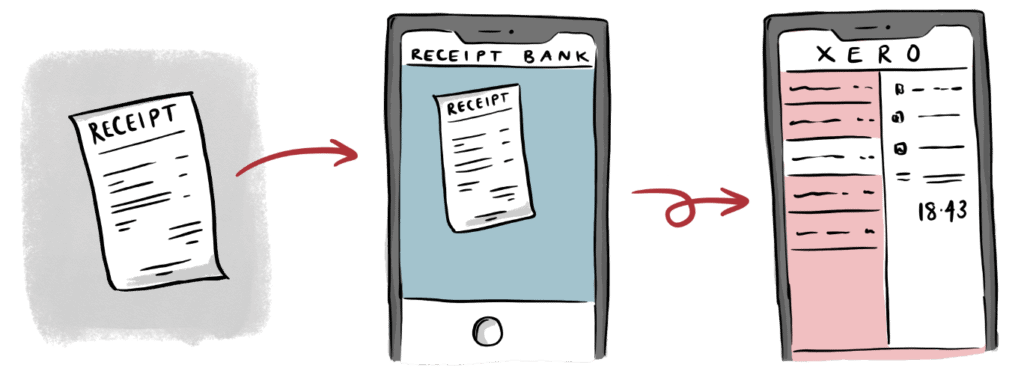

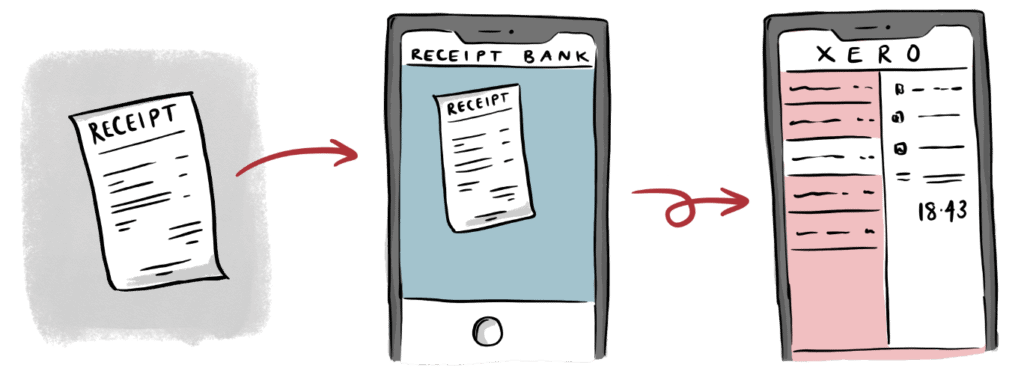

Following registration businesses must collect VAT receipts for all business purchases, showing the supplier’s VAT registration number, with the VAT amount itemised separately. Card receipts cannot be used to reclaim VAT. You can find some examples of best practice for submitting VAT receipts here.

The business must also submit quarterly VAT returns, which are due one month and seven days after each quarter end. When acting as your agent for VAT submissions Barnes & Scott will send you a draft VAT return, which you must review and approve before we submit it to HMRC. You will then need to pay the VAT due before the appropriate deadline. As a basic rule of thumb, we suggest setting aside around one-sixth of sales revenue each month for VAT payments. If you would like to set up a direct debit to collect VAT payments automatically, please let us know and we will arrange this for you.

When submitting your first return you can also claim VAT prior to the date of registration for the last six months’ worth of services purchased and the past four years’ worth of goods purchased. To take full advantage of this you will need to ensure you have submitted all relevant receipts to Dext. So when you receive a VAT receipt for purchasing any goods or services, you should think of this as a voucher to enable you to reclaim the VAT!

As most start-ups can reclaim VAT on their first few returns, HMRC tends to investigate these returns, to ensure the business has put processes and appropriate documentation in place to support the reclaim process. Barnes & Scott can play an important role here, ensuring everything is fully audit-proof and giving you peace of mind. We say we aren’t scared of HMRC inspections – we embrace them! Meanwhile, you can focus on running your business.

If you miss the deadline for submitting a return or making a payment you may have to pay penalty charges and interest on late payments. A new regime for penalty charges was introduced in early 2023 and applies to all VAT submissions and related payments due on or after January 1 2023. The new regime is points-based, with the intention of being more lenient to companies that occasionally submit returns or make payments late, while levying tougher sanctions on those who repeatedly miss deadlines.

Miss a return submission deadline and your company will receive one penalty point, with a fixed penalty charge of £200 issued once a set threshold for numbers of points has been reached – for businesses submitting quarterly returns the threshold will be four points. Once that first penalty has been charged another £200 penalty will then be charged for any subsequent late submissions.

The number of points a business has against its name can be brought back down to zero if it meets every submission deadline over a set period (in the case of quarterly filers this would be 12 months), and if all VAT returns due within the previous two years have been received by HMRC. If the points total remains under the threshold for a penalty charge, individual points expire automatically after two years.

Late payment penalties vary depending on when payment reaches HMRC. Pay in full or make arrangements for a Time To Pay between day one and day 15 after a missed payment and the business will escape a penalty. But if you fail to do this an initial penalty will be charged at 2% of the amount that was outstanding on day 15.

If payment has still not been made by day 31 the business then incurs further penalties. Pay in full or arrange a Time To Pay on day 31 and the business would again be charged 2% of what was outstanding on day 15, plus 2% of the amount outstanding on day 30. If no payment or arrangements have been made by the end of day 31 penalties ratchet up each day until payment is made in full, based on a 4% annual rate.

HMRC has also introduced late payment interest, which is also calculated on a daily basis, from the day after payment was due until the day payment is made in full, and based on an annual rate of 2.5% plus the Bank of England base rate per year. You can find out more about these penalties here.

If you purchase services from suppliers based in EU Member States these are usually free of VAT. It is important to be aware of which suppliers fall into this category. For example, Microsoft, Google, Amazon, Dropbox and Facebook are all now operated from the EU, so you should not pay VAT to any of them. You can ensure this is the case by entering your VAT number into customer account settings for each of these suppliers, then checking everything is in order by making sure the VAT rate is set at 0% on any invoices the suppliers send you.

You can find more information about VAT rates and how to use them with Xero for purchases in our Knowledge Base. You can also find out more about some additional rules that apply to goods or services sold to customers in the EU, including which VAT rates to use when creating sales invoices, on the same page.

It’s well worth taking a look at the full range of useful VAT-related content that HMRC has made online.

If you have any questions about registering for VAT and what happens once you have done so, please do get in touch. We would be delighted to talk to you about your requirements and to help you decide when it would be best for your business to take this next important step in your journey.

We use technology to do the heavy lifting, resulting in a Zen-like state for your finances, freeing up headspace to run your company.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.