If Netflix, Zoom or Spotify started in London today, we’d be their first choice for finance and tax support.

We were the first Chartered Accountancy firm to specialise solely in tech, digital and fintech start-ups. Having been a start-up once ourselves (estab. 2012), we instinctively know what growing companies need. We provide a one-stop shop for accounting, tax and business advisory services for ambitious companies who want to change the world.

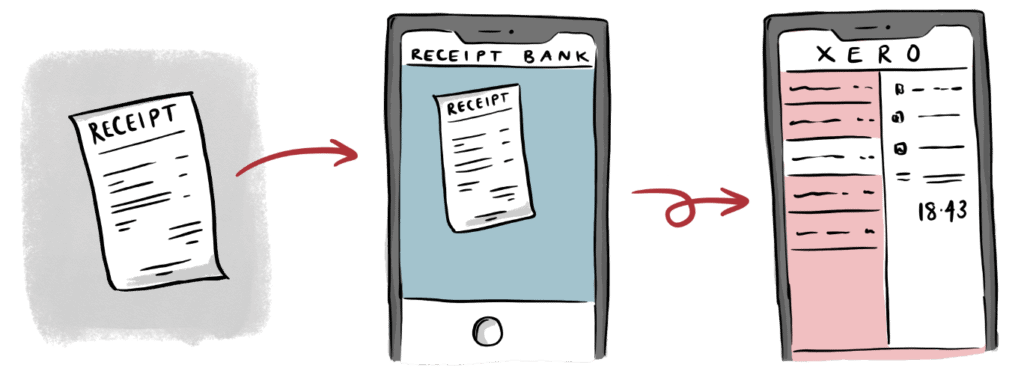

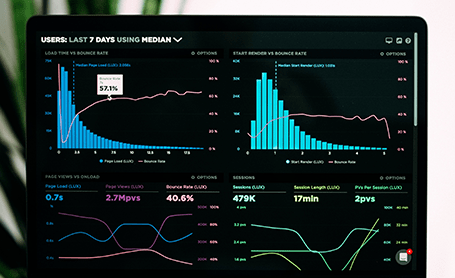

We’ll help you raise capital, pay less tax and scale your business. We provide a strong financial base that can help your company thrive, become more nimble and more resilient. We can promise you 100% financial and business insights and zero BS or accounting jargon. Our cloud-based software is easy to use and will give you a live view of your company’s finances.

We use technology to do the heavy lifting, resulting in a Zen-like state for your finances, freeing up headspace to run your company.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.