The time and effort that it takes to find and hire employees can be significant for high growth technology businesses. However, holding onto workers is even harder. The job for life no longer exists, and increasingly the millennial workforce seeks to move around in their career or in many instances prefer to start their own businesses after a few years experience.

Introducing an Enterprise Management Incentive (EMI) share scheme can be an effective way to attract and retain key staff. The main feature of the scheme allows employees to be granted share options at a discounted rate in the future, by agreeing a set present company valuation with HMRC.

This incentivises staff to stick around until options vest and subsequently increase in value. Additionally, EMI is tax-efficient for workers, meaning that staff can reap most of the spoils when the shares vest.

The scheme is suitable for high growth (i.e. technology companies) and/or businesses whose primary focus is on developing intellectual property which (at least in the short term) means that they are targeted on building up company value rather than profits, and in some instances revenues.

While these companies often raise equity investment, which allows them to sustain losses in the short term, they need to be mindful of their cash management and burn rate. This means that they may have limited budgets for staff and will have difficulty in filling roles that require specific expertise.

Introducing an EMI scheme can help attract experienced staff members, who believe in the long-term potential of the company and who are then prepared to receive a lower salary. That said, consideration should be taken before setting up and administering EMI schemes. Many accountants and business advisers recommend for their startup clients to introduce EMI schemes from day one. However, whilst costs associated with schemes are tax-deductible, they are expensive to run due to ongoing requirements and regular company filings.

Barnes & Scott’s preferred approach is to not encourage relevant clients to set up schemes until they have been trading for at least two years. Coupled with the expense of EMI schemes, shares in early-stage companies often have little value. We believe that companies should instead wait to see if they build momentum to justify the cost and administrative burden of setting up a scheme.

The qualifying conditions for EMI schemes are outlined by HMRC and consist of criteria that relate to both companies and employees.

The main criteria are as follows:

Company

In addition to company costs associated with setting up and managing schemes being fully tax-deductible, issuing businesses are also able to receive corporation tax relief when qualifying shares are acquired by employees upon the exercise of their EMI options.

The value of this deduction is calculated as the difference between the market value of shares when they are exercised and the amount paid for them by employees.

Employees

One of the main attractions of EMI over other types of schemes (i.e. unapproved options and ordinary shares) is that their tax benefits are more flexible and generous for employees.

Exercise of options

No income tax or NICs on shares are payable when an employee accepts the initial grant of options. When options are exercised, there is only an income tax liability if the exercise price is less than the market value when they were first granted. In these rare instances, holders will also be liable to NICs if their shares are classified as readily convertible assets.

Sale of shares

Employees will have to pay capital gains tax on exercised options when the shares are sold, calculated as the difference between their exercise price and market value at grant. In most circumstances they will qualify for entrepreneurs relief, meaning that capital gains will be payable at a reduced rate of 10% as opposed to the standard 20%.

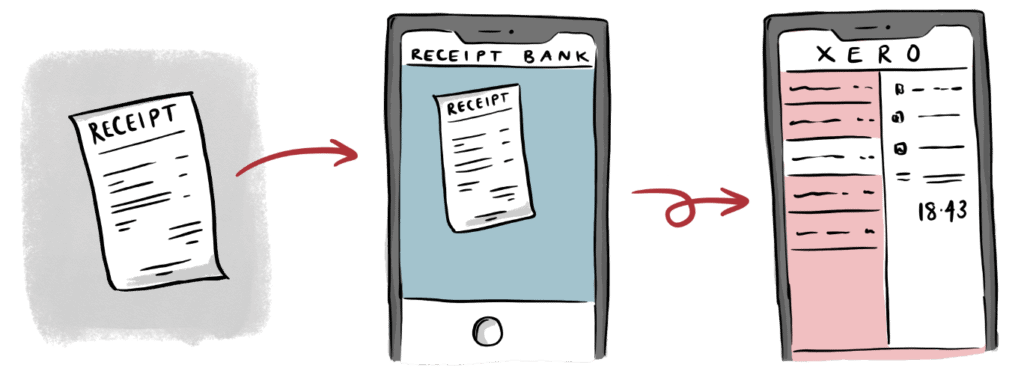

We use technology to do the heavy lifting, resulting in a Zen-like state for your finances, freeing up headspace to run your company.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.