Unapproved options sound like a scary prospect! But they don’t need to be. Options are only called ‘unapproved’ because they don’t fit into the EMI (Enterprise Management Incentive) scheme. However they still have their place in high growth companies and can be an effective tool to attract, retain and reward your team.

Most startups utilise the EMI scheme in order to issue options to their employees, because it is HMRC approved and very tax efficient. But EMI options do not work for everyone. For example, contractors or non UK employees do not qualify for the scheme. Also, startups that have breached the EMI thresholds (£250k per employee and/or £3m in total) are unable to issue further options under the scheme, any new options would then default to being unapproved.

An unapproved option scheme does have benefits though. Firstly, start-ups can be far more flexible with the terms and conditions, as the strict HMRC guidelines don't need to be followed - they can be offered to anyone, anywhere, at any time! Vesting criteria can be relaxed or even tightened during the option period, something that can't be done with an EMI. Furthermore, a formal HMRC valuation is not required, and the exercise price can be set as low (or as high) as you like.

The main difference in terms of tax between an EMI option and an unapproved option is that an EMI options are generally taxed on the option holder as capital whereas unapproved options are typically taxed as income. Capital gains usually have a lower tax rate and can be reduced further by reliefs such as 'business asset disposal relief', meaning that under an EMI scheme individuals could pay a tax rate of only 10%, whereas under an unapproved scheme the tax rate can be up to 45%. However, this tax is paid by the employee, and not the company.

From the company's perspective, the tax effects are broadly similar under both schemes. A corporation tax deduction is received when options are exercised, based on the market value less the exercise price. This applies to both EMI and unapproved schemes. However, under an unapproved scheme, this relief only applies to UK employees, not contractors or workers abroad.

Whilst unapproved option schemes may not be as tax effective for the option holders, they still have their place in high growth companies. They are flexible, easy to implement and can be issued more widely than their EMI counterparts.

Often, from the company's perspective, the tax effects are the same.

But they are best used strategically, for example, only when the EMI limits have been breached, or if an individual is not on payroll or based in the UK.

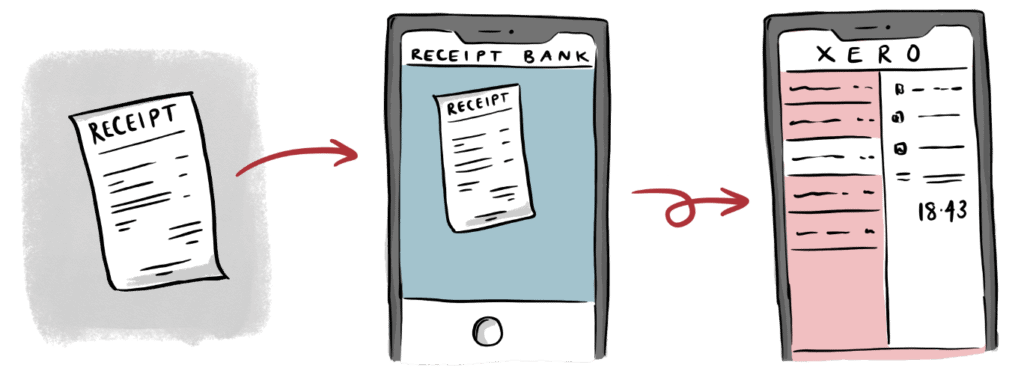

We use technology to do the heavy lifting, resulting in a Zen-like state for your finances, freeing up headspace to run your company.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.