At the Budget in November 2021, the government announced a number of proposed changes to the Research and Development Expenditure Credit (RDEC) and the SME R&D tax relief schemes. The government has said the changes are designed to support modern R&D methods, to refocus its support on R&D activity happening in the UK; and to identify and try to eliminate abuses of the reliefs system.

In addition, HMRC is conducting extra reviews of R&D reliefs claims in an attempt to reduce fraud; and may introduce anti-fraud processes that will require businesses and their agents (such as Barnes & Scott) to provide more information when making claims.

The proposed changes would be included within the 2022/2023 Finance Bill, so would only take effect in April 2023. The government intends to publish draft legislation in the summer of 2022, when it will ask again for input from stakeholders to help shape the legislation that is then presented to Parliament.

The costs of subcontracting R&D work will only be eligible for R&D tax credit claims if the work is carried out in the UK

The government is proposing to limit relief to subcontracted R&D activities that take place in the UK, but businesses will be able to claim relief on the costs of software purchased overseas; and they will still be able to deduct the costs of subcontracting activities that take place overseas from their taxable profits.

In addition, from April 2023, claims for expenditure on Externally Provided Workers (EPWs) carrying out R&D activities will only be allowed for EPWs who are paying taxes via PAYE and NIC.

These sorts of changes were expected, in part because we know the government wants to curb shell companies’ use of R&D claims, when such companies are only making limited contributions to the UK economy. ONS figures suggest that while UK companies claimed tax relief on £47.5 billions’ worth of R&D expenditure in 2019, only £25.9 billion of that money related to R&D activity that took place in the UK.

We are concerned that these changes could have an adverse effect on some of our clients, who may subcontract R&D work to companies and individuals working overseas, because the supply of specific skills and talent may lead them in that direction and the cost of that expertise may be relatively low.

However, the details of how this change will be implemented in practice have not yet been finalised. In particular, the government has said it will consider arguments in favour of making narrow exceptions that would allow claims on overseas R&D activity in specific circumstances.

At Barnes & Scott we believe that some R&D costs incurred overseas should be claimable. We support the government’s aim of trying to boost the UK economy by encouraging businesses to work with UK-based subcontractors, but we do not think this should mean that our clients’ legitimate, innovative R&D activity or strategic development should be penalised as a result.

It will now be possible to claim for data and cloud computing costs

Claims will now be allowed for license payments for datasets; and for cloud computing costs attributed to computation, data processing and software elements of R&D activities – even if the supplier of those services is based overseas.

This is a very welcome new allowance, which effectively modernises outdated R&D legislation to recognise the importance of cloud-based data analysis and processing in modern R&D methods. It will also be possible to claim reliefs on payments for data and cloud computing services that are sourced overseas, as these are considered inputs to UK-based activity.

There are some exceptions: in an attempt to ensure that claims only apply to costs incurred in R&D activity, business will not be able to claim relief for the cost of datasets that can be resold or will have a lasting value to the business beyond the end of the R&D project.

In addition, if a business is using multiple datasets or other services through an end user agreement with a supplier, but not all those datasets or services will be used in the R&D project, claimants will need to apportion costs appropriately. The government also wishes to maintain its current stance in relation to general overhead costs, so it will not be possible to claim R&D reliefs on the costs of data storage or server capacity.

But overall this is a positive change, which will have a positive impact on most R&D claims. Again, we have an opportunity to help influence the details of the proposed legislation, because the government says it will consider feedback on how this will work in practice. It has highlighted in particular the challenge of defining how and when specific costs are spent during cloud-based R&D activity: which elements of a package of services should or should not be eligible for reliefs; and how those costs should be apportioned.

HMRC has hired 100 new inspectors and is carrying out extra reviews of R&D claims as it tries to clamp down on fraud. These new measures are being taken following a big increase in the number of R&D claims in recent years, many of which have been made via unregulated, self-styled ‘R&D advisers’, which proactively contact small businesses and offer to make claims on their behalf on a commission basis.

These companies are neither regulated nor the members of a professional body. They have encouraged some spurious and fraudulent claims activity in recent years: the Treasury says they have submitted “numerous dubious claims”. Tackling such activities will form part of an attempt to reduce errors and fraud in the R&D tax relief schemes, which HMRC estimates cost £311 million in 2019/2020.

HMRC will also be asking for more detailed information to be provided to support R&D claims and it may introduce a mandatory advance assurance regime. This would mean that companies would need to provide additional information when making claims, including details of expenditure the claim will cover, the scope of the R&D activity, including its aims and the nature of the technology being used.

Claims will have to be made digitally; and will need to be endorsed by a named, senior officer of the company. The company will also need to inform HMRC in advance that a claim will be made and will need to provide details of any agent (in this case, Barnes & Scott) advising the company on the claim.

We have dealt with similar processes in the past and can help you to comply with all of these requirements, to ensure that having to go through these processes does not create any extra administrative work or problems for you.

Each of these proposed changes highlight the value in working with professionally regulated and experienced tax advisers – such as Barnes & Scott – when submitting R&D claims.

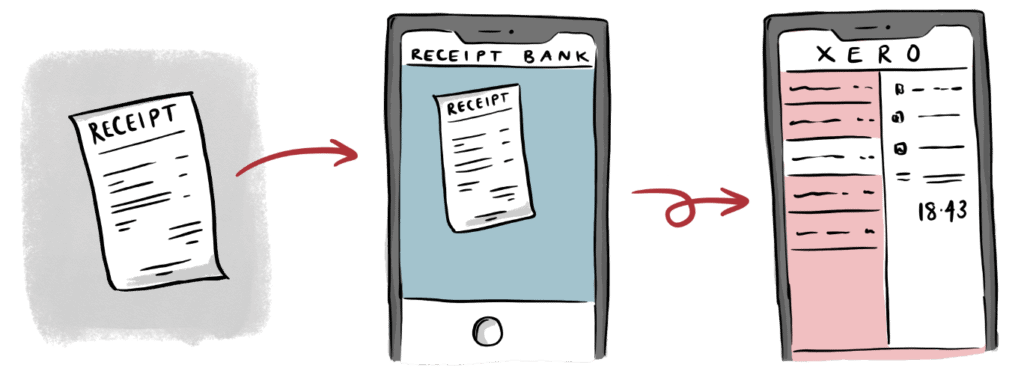

We use technology to do the heavy lifting, resulting in a Zen-like state for your finances, freeing up headspace to run your company.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.