You want your business to be more streamlined, so that it’s easier for you to grow and adapt. It all starts with the finance system. It’s this, coupled with our advice, that can help you save money and make money.

It’s a blueprint for success, and it’s made up of four simple steps:

We give you access to software that makes your life easier, eliminating laborious tasks and automating your processes.

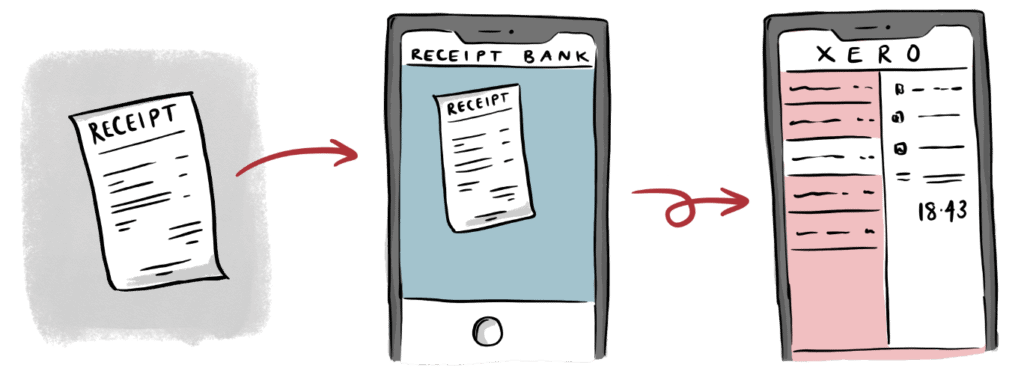

We set you up with two cloud-based software packages that we use ourselves – Xero and Receipt Bank.

The software is easy to operate, connects your accounts directly to us, and gives you a live view of your financials. It’s compatible with your smartphone and tablet, so you can access it from anywhere.

As a Xero Gold Partner we’re experts in using the software and receive regular training to keep ourselves updated. We will set up and customise Xero to suit your business and show you how to use it. If you need help, we’re always available.

With our help you are left free to concentrate on other, more important things – like increasing your profits and growing your business.

We’ll handle all your bookkeeping and accounting needs, including end-of-year accounts, Corporation Tax returns and VAT returns.

Many of our tech-start up clients are based in the UK but have global sales. We can handle all your UK and international tax needs, including VAT MOSS for sales of digital services to customers in the European Union. We’ll ensure that you comply with tax rules and pay the least amount of tax possible.

Running a payroll can be stressful and time consuming. Let us run it. We’ll check for any changes to staff or salary details before the monthly pay run, process the pay run, send each employee a digital payslip and notify HM Revenue and Customs (HMRC) in real time when the payment is made.

All companies must submit annual accounts to HM Revenue & Customs (HMRC) after the end of their financial year (you normally have nine months to do this). Let us take the stress out of this process. We’ll prepare and file your accounts, handle all the admin ‒ and any queries from HMRC.

This site uses cookies to provide you with a great user experience. By visiting barnesandscott.com, you accept our use of cookies.